Maintaining a healthy smile is crucial, but dental care costs can be a significant concern. This is where dental insurance comes in, helping to cover the expenses of routine check-ups, preventative care, and major procedures. Understanding the nuances of dental insurance can be challenging, but this guide will break down the types, benefits, and mechanics of how it operates.

What is Dental Insurance

Dental insurance is a type of coverage designed to help individuals and families manage the costs of dental care and treatments related to oral health. Instead of paying the full cost of services out-of-pocket, policyholders pay a regular premium, and the insurance plan covers a portion of the expenses.

How Dental Insurance Works

Dental insurance functions differently from medical insurance. Instead of covering a large percentage of catastrophic events after a high deductible, most dental plans focus on preventative care and establish annual maximums (the total amount the insurer will pay in a given year, typically ranging from $1,000 to $2,000).

Plans usually operate on a “100-80-50” model, though specific percentages vary:

- 100% Coverage for Preventative Care: This includes routine services like cleanings, oral exams, and X-rays.

- 80% Coverage for Basic Procedures: This typically covers services like fillings, simple extractions, and sometimes root canals.

- 50% Coverage for Major Procedures: This covers more complex treatments such as crowns, bridges, dentures, and oral surgery.

Before coverage kicks in, you may need to meet a deductible (a fixed amount you pay out-of-pocket annually). Many preventative services bypass the deductible entirely. After your deductible is met, you may still be responsible for a copayment (a fixed fee per service) or coinsurance (a percentage of the total cost).

Common Types of Dental Insurance Plans

Choosing the right plan depends on your budget, your oral health needs, and whether you have a preferred dentist.

PPO (Preferred Provider Organization)

PPO plans offer flexibility. You can visit any licensed dentist, but you will pay significantly less if you choose a dentist “in-network” who has agreed to negotiated rates with the insurance company.

- Pros: Freedom to choose your provider; lower out-of-pocket costs when staying in-network.

- Cons: Higher premiums than HMOs; more paperwork if you go out-of-network.

HMO (Health Maintenance Organization) or DHMO (Dental HMO)

HMO plans require you to select a primary care dentist (PCD) from a specific network. This PCD manages all your dental care and referrals to specialists. You generally have no coverage if you seek care outside the network.

- Pros: Lower monthly premiums; typically no deductibles or annual maximums; fixed copays for procedures.

- Cons: Very limited choice of dentists; must get referrals for specialists.

Dental Discount Plans (Not technically insurance)

These plans are membership programs where you pay an annual fee and receive a discount (usually 10% to 60%) on services from a list of participating providers.

- Pros: Immediate activation; no deductibles, maximums, or paperwork; ideal for those needing immediate major work not covered by waiting periods.

- Cons: Not insurance; you still pay a portion of every bill.

Indemnity Plans (Fee-for-Service)

These are less common today. You see any dentist, pay the dentist directly, and then submit a claim for reimbursement. The insurer typically pays a set percentage based on “usual, customary, and reasonable” (UCR) charges.

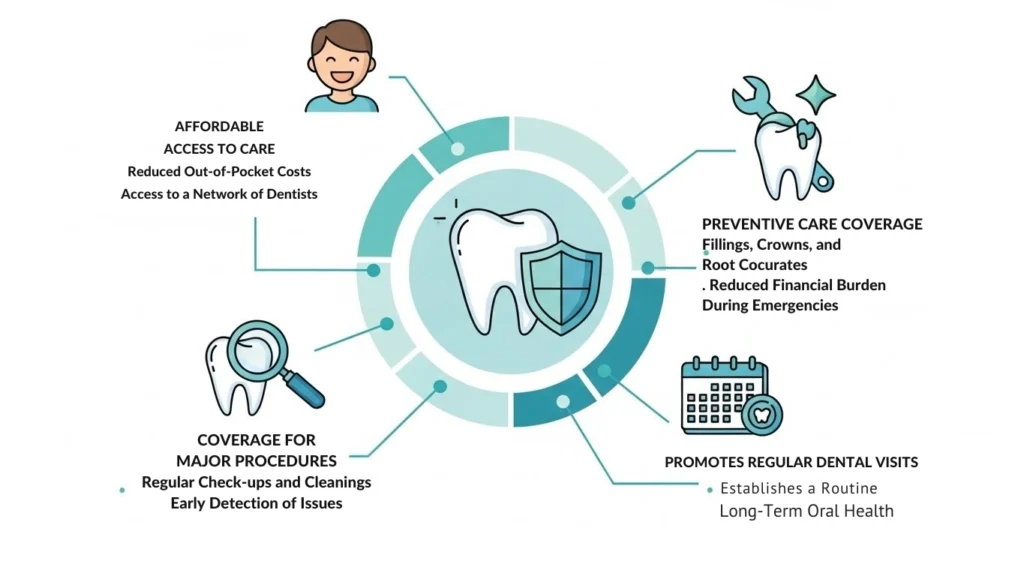

The Benefits of Having Dental Insurance

The primary benefit of dental insurance is financial protection and peace of mind.

- Focus on Prevention: Plans emphasize preventative care to catch issues early, which saves money in the long run. A simple filling is significantly cheaper than a root canal and a crown.

- Predictable Costs: You know your copays and coinsurance rates upfront, making budgeting for dental work easier.

- Access to a Network: Insurers negotiate lower rates with providers, meaning the “allowed amount” for a covered procedure is typically much lower than the dentist’s standard fee.

Key Terms to Know

- Premium: The monthly amount you pay for coverage.

- Deductible: The amount you pay out-of-pocket before your plan starts to pay.

- Annual Maximum: The most the insurance company will pay for your dental work within a plan year. This amount resets annually.

- Waiting Periods: Many plans impose waiting periods (e.g., six months for basic fillings, 12 months for major crowns) before they will cover non-preventative procedures.

- In-Network vs. Out-of-Network: Dentists in-network agree to the insurer’s pricing schedule, resulting in lower costs for you.

Making the Right Choice

When selecting a plan, consider:

- Your Current Oral Health: If you anticipate needing major work (crowns, bridges), an HMO with no annual maximum might be better, despite network restrictions.

- Your Preferred Dentist: If you love your current dentist, ensure they are in-network with the PPO plan you select.

- Cost vs. Flexibility: Weigh the lower premiums of an HMO against the freedom of a PPO.

Dental insurance is a vital tool for managing oral health expenses. By understanding these options, you can select the coverage that best fits your needs and budget, keeping your smile healthy for years to come.